“What doesn’t kill you makes you stronger”

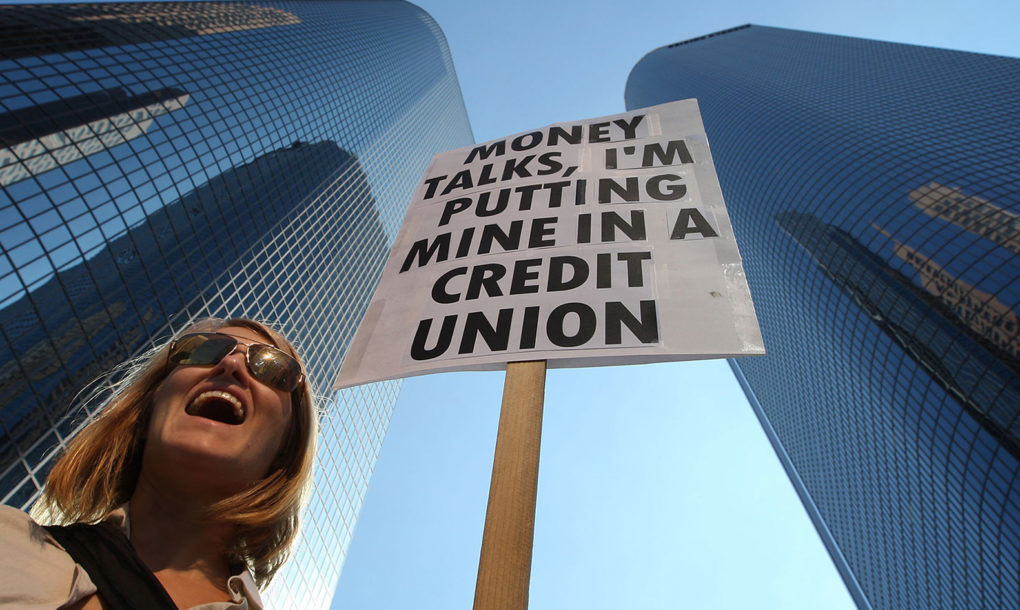

The Credit Union landscape has changed drastically in the past 10 years, once perceived as the poor cousin of retail banking they are now poised for big growth and a seat at the financial top-table.

This is due in part to the Credit Union’s sensible behaviour during the boom, a sentiment echoed by the Central Bank when they said: “The Credit Union sector in Ireland is emerging from this broader financial crisis arguably less bloodied than many other sectors (notably banking) and from what I can see, definitely unbowed. “

Further research carried out by Amarach in 2013 reveal the changing tide among the Irish Public with a popularity rating 3 times that of pillar banks AIB and BOI. Key contributors to the Credit Union’s popularity is their handling of loans and savings.

The relative frugality expressed by Credit Unions in their day to day operations and loan-book management is not the lone component of their commercial renaissance however.

A Cultural shift and refocus on Customer Experience has been core to the shift in customer opinion. This refocus has been inspired by strong leadership and a business offering powered by technology.

The addition of ATMs to Credit Union premises along with the roll-out of Debit Cards and Online Banking have brought Credit Unions into the modern era of banking. The ongoing digital transformation of Credit Unions along with the consolidation currently happening means that Credit Unions have a very bright future indeed.

Supporting Digital Services

New services and a focus on digital requires reliable infrastructure to support day to day operations. Many Credit Unions have sought to move to the cloud with back-office solutions like Office 365 proving very suitable for many of our clients. 365 allows Credit Union admin and management to manage spreadsheets through excel, communicate remotely through Skype for Business and Outlook and manage internal projects using MS Teams and SharePoint. All activity and documentation can be stored securely in OneDrive for Business.

CyberSecurity

In her Credit Union Report, Registrar of Credit Unions, Anne-Marie Mckiernan stated that “The incidence of cyber-attack and business interruption is on the increase and credit unions should assume they will be targeted.” But Security is not a patching job and effective architecture is crucial to securing your organisations internal and customer data. Some areas of particular concern for Credit Union security include:

- Encryption of Sensitive data

- Integration of data loss prevention measures

- Conduct periodic risk assessments or to correct vulnerabilities discovered in assessments

- Changing default security passwords on new equipment or software

- Absence of appropriate policies

- Insufficient employee training or awareness and

- Insufficient dedicated security roles.

When talking about security, it’s good to use the metaphor of the cash vault as outlined by Ben Rogers of the CU-Times.

Take a look at your vault: Massive steel door, dual key access, concrete encasing. A lot of time and technical wisdom has gone into the making of a secure vault. The risks of a vault theft are real, but well understood. Now take a look at the security protecting your IT Infrastructure!! A lot of importance is placed on securing your cash vault but often times, cyber security is only given the minimum attention and investment.

Progressive Credit Unions are future proofing their business.

Over the past 12 years, ActionPoint have worked with some of the country’s largest credit Unions assisting them on the road to digital transformation while also providing the infrastructure to keep their businesses functioning in increasingly malicious cyber environments.

Some services that we are actively providing our clients include:

- Infrastructure Management

- End-User Support

- IT Security

- Mobility

- Business Continuity

More important than the technology however, is the relationship, ActionPoint was founded on some strong core values including: a commitment to truly serve, to do what’s right, to be super organised and to always be ready to go the extra mile. We feel these values align closely with those of Credit Unions and this cultural fit has proven to be very effective with the many Credit Unions we serve today including St.Pauls Garda, Tralee, MPCC and St.Francis’ of Ennis.

Final Thoughts

Today Credit Unions can boast over 2.9 million members with savings approaching €11.9 billion, 9,200 active volunteers and over 3,500 employed. This collective strength complimented with a tailor made service has put Credit Unions in a commanding position. The final piece of the puzzle and perhaps the most crucial is a technology partner that can support you.

We would be delighted to be that partner, but first, let’s have a conversation.